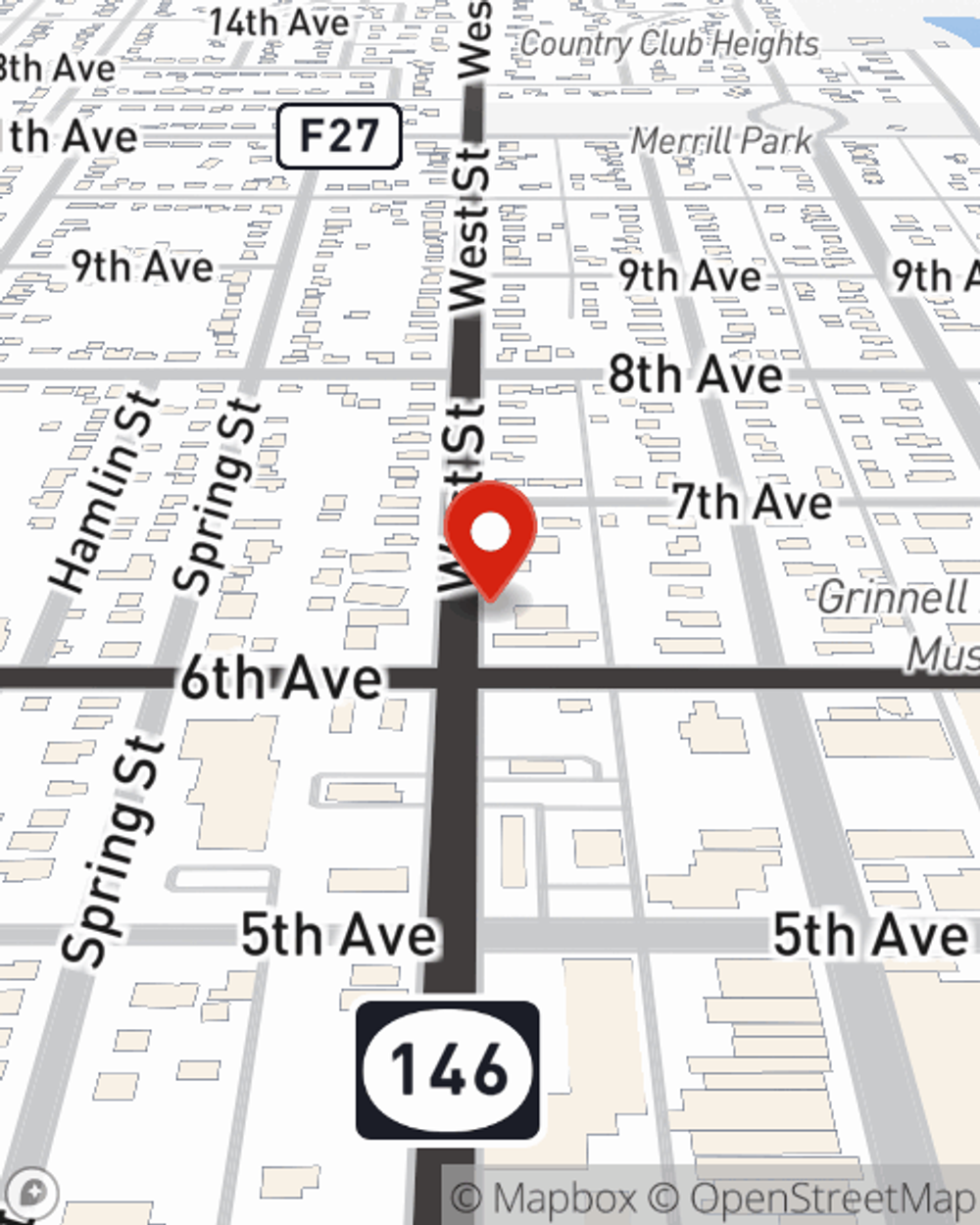

Business Insurance in and around Grinnell

One of Grinnell’s top choices for small business insurance.

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Brent Nickel knows what it's like to put in the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to learn more about.

One of Grinnell’s top choices for small business insurance.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

For your small business, whether it's an ice cream shop, a dance school, a pet groomer, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, accounts receivable, and business liability.

At State Farm agent Brent Nickel's office, it's our business to help insure yours. Visit our terrific team to get started today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Brent Nickel

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.